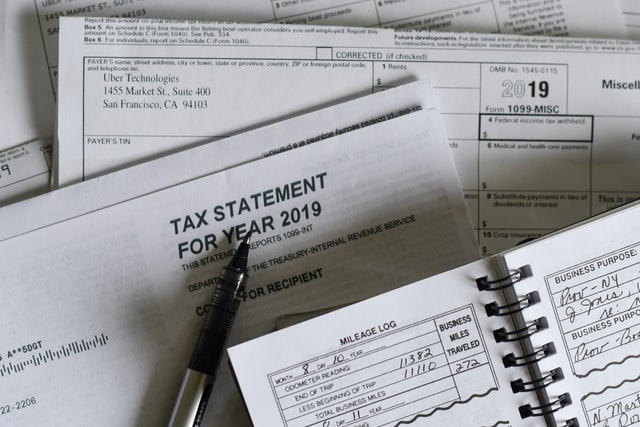

Time is one of the most important actives in your company. At Danzai Software, we know this and because of that, we have incorporated direct communication with tax authorities. This, is going to allow you make an agile tax presentation, saving time and investing it on real useful tasks for you and your company.

On Dansap ERP, you are going to find a great ally in your accounting department. We are going to help you controlling all the aspects related to your accountability and tax presentation that consume a lot of time through the year. Automating this task, has been a challenge, but we have assumed a compromise and rigor, in order to offer the most complete tool for your company.

In what has improved Dansap ERP?

303 tax presentation, direct communication with tax authorities.

The 303 model, filed quarterly, is used to inform the auto liquidation of the taxes. This declaration, must be submitted even if there has been no activity.

Presentation dates of form 303:

- First quarterly, from the 1st until 20th of April.

- Second quarterly, from 1st until 20th of July.

- Third quarterly, from 1st until 20th of October.

- Fourth quarterly, from 1st until 30th of January.

In this one, we are going to do various things:

- Declare facts of tax significance.

- We liquidate what corresponds to us.

Whether only one quarter or all of them are filed, form 390, which corresponds to the annual return, must be submitted.

390 tax presentation, direct communication with tax authorities

The 390 model, is the annual declaration of the IVA. The 390 model, is going to synthetize the 303 model and wants to offer a better breakdown of operations. It is presented once a year.

Presentation dates of form 390:

- From the 1st until 30th of January.

It is compulsory present this model, otherwise, the penalty fee is going to be the 50% of the tax you must pay. Big corporations don’t have to present this model, as they are registered on the Monthly Register of VAT Refunds that invoice more than 6.010.121,04€/year.

At Danzai Software, we know the time that tax presentation represents, for that, we have invested a lot of time on having a direct communication with tax authorities, streamlining this processes by a 500%.

303 and 390 tax presentation, close the accounting exercise in relation to the invoices received. The area of the company to which it refers to income and expenses, must be well dotted. To present this models correctly, detecting some mistakes. ¿Do you have doubts? At Danzai Software we will advise you without compromise and help implement our management software in the company. Contact us!